By 2025, Medicare Part D formularies have become a lifeline for millions of seniors and people with disabilities who rely on affordable prescription drugs. If you're taking generic medications - and most people are - understanding how these formularies work isn't just helpful, it’s essential to avoid surprise bills. The system has changed dramatically since 2024, especially with the new out-of-pocket cap and updated cost-sharing rules. This isn’t about jargon. It’s about knowing exactly what you’ll pay, when, and why.

What Is a Medicare Part D Formulary?

A formulary is simply a list of drugs your Medicare Part D plan covers. Every plan has one, and it’s not the same across the board. These lists are created by Pharmacy and Therapeutics (P&T) committees - groups of doctors and pharmacists who decide which drugs get included based on safety, effectiveness, and cost. But here’s the key: every plan must cover at least two different generic versions of every drug in a therapeutic class. That means if you’re on blood pressure medication, your plan can’t just cover one generic - it has to offer at least two options.Formularies are divided into five tiers. Generics live mostly in Tier 1 and Tier 2. Tier 1 is for preferred generics - the cheapest, most commonly used versions. Tier 2 is for non-preferred generics, which cost a bit more. Brand-name drugs? They’re usually on Tier 3 or higher. The higher the tier, the more you pay.

How Much Do Generics Cost in 2025?

In 2025, the standard Part D deductible is $615. After you pay that, you enter the initial coverage phase. For generic drugs, you pay 25% of the cost - the rest is covered by your plan. But here’s where it gets tricky: the 25% is calculated differently than it was before. For generics, your actual out-of-pocket payment counts toward your annual limit. For brand-name drugs, 70% of the drug’s full cost (even if you didn’t pay it) counts toward that limit. That’s a big deal if you’re taking both types of meds.What does that look like in real dollars? A 30-day supply of a Tier 1 generic like lisinopril (for blood pressure) might cost you $0 to $15. A Tier 2 generic like metformin (for diabetes) could run $15 to $40. Compare that to a brand-name drug in Tier 4 or 5 - those can easily hit $100 or more per month. That’s why nearly 92% of all prescriptions filled under Part D in 2023 were generics.

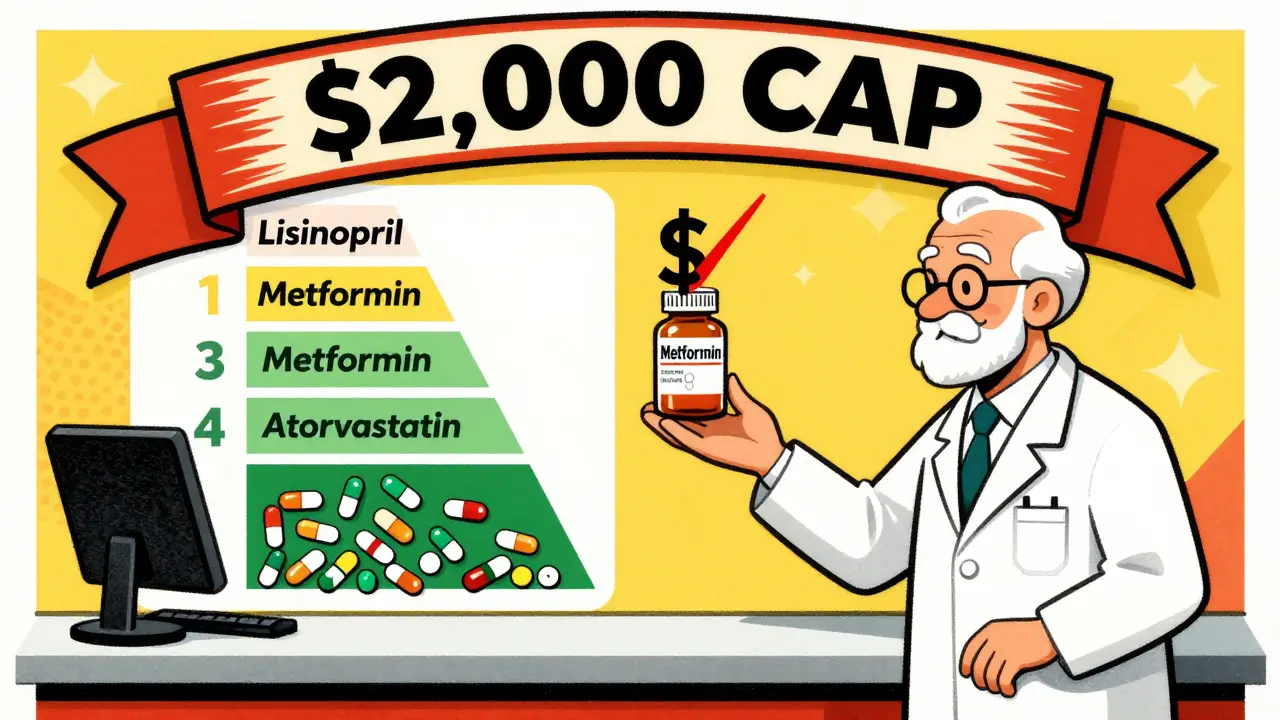

The $2,000 Out-of-Pocket Cap Changed Everything

Before 2025, there was a gap in coverage called the “donut hole.” After you spent a certain amount, you paid 100% of your drug costs until you hit a high-out-of-pocket threshold. That’s gone. Starting January 1, 2025, the maximum you pay for all covered drugs - brand or generic - is $2,000 per year. In 2026, it goes up to $2,100.Once you hit that cap, you enter catastrophic coverage. From that point on, you pay $0 for every covered generic drug for the rest of the year. No coinsurance. No copay. Nothing. That’s a massive win. The Inflation Reduction Act made this happen, and it’s already saving beneficiaries an average of $450 a year on generics alone.

But here’s the catch: you still have to pay your 25% coinsurance during the initial coverage phase. If you take three generics that cost $50 each, you’re paying $15 per month - $180 a year. That’s manageable. But if you’re on six or seven generics, those costs add up fast. That’s why the cap matters so much. It’s your safety net.

Why Some Generics Aren’t Covered - Even If They’re the Same Drug

You might be surprised to learn that two generics can be chemically identical but still treated differently by your plan. That’s because Medicare plans don’t have to cover every version of a generic. They only need to cover at least two. So if your plan covers Amlodipine Besylate made by Company X, but you’re used to Company Y’s version, your plan might not cover it - even though they’re the same drug.This is called “therapeutic interchange.” Pharmacists can substitute one generic for another unless your doctor says “dispense as written.” But if the substitute isn’t on your plan’s formulary, you pay full price. A Reddit user in the r/Medicare community reported being charged $120 for a generic heart medication because their plan only covered a different generic in the same class. That’s not a mistake - it’s policy.

That’s why checking your plan’s formulary before you enroll is critical. Don’t assume your current generic will be covered. Type the exact drug name - including the manufacturer if you know it - into the Medicare Plan Finder tool. If it’s not listed, you’re out of luck unless you file a coverage exception.

How to Save More on Generics

There are smart ways to cut your generic drug costs even further:- Choose a $0 deductible plan: Over half of stand-alone Part D plans in 2025 have no deductible. If you take multiple generics, this saves you $615 right off the bat.

- Use mail-order pharmacies: Many plans offer 90-day supplies at lower copays. That’s three months of meds for the price of two.

- Check for manufacturer coupons: Some generic makers offer discounts through their websites. These can stack with your Part D coverage.

- Ask for a coverage determination: If your needed generic isn’t covered, you can appeal. CMS data shows 83% of these requests are approved, especially if your doctor explains why the specific generic is medically necessary.

- Compare plans every fall: 37% of plans change their generic tier placement each year. What was Tier 1 last year might be Tier 2 this year. Use the Medicare Plan Finder during Open Enrollment (October 15-December 7) to find the best deal.

What’s Changing in 2026 and Beyond

The changes aren’t stopping. In 2026, Medicare plans must include a “generic price comparison tool” in their member portals. That means you’ll be able to see, side by side, which generic version of your drug costs the least - even if it’s made by a different company.Starting in 2029, the government will start negotiating prices for certain generic drugs. Insulin glargine (the generic version of Lantus) is already on the list. That could bring prices down even further.

Meanwhile, experts are pushing for a rule that would require plans to cover all generics in a class if they cover any one of them. Right now, you might be stuck paying full price for a generic just because your plan picked a different one. If that rule passes, it would eliminate a huge source of confusion and cost.

Real People, Real Savings

One beneficiary in Ohio told KFF she pays $0 for three generics - metformin, lisinopril, and atorvastatin - because they’re all on Tier 1 of her plan. She saves over $300 a month compared to what she paid before Medicare. Another in Florida said he was hit with a $200 bill last year because his plan switched his generic blood pressure med without telling him. He filed an appeal, got approved, and now his costs are back to $15 a month.These aren’t rare stories. The Medicare CAHPS survey shows 87% of people who use mostly generics are satisfied with their coverage. Only 76% of those on brand-name drugs say the same. Why? Because generics work. They’re safe. They’re effective. And now, thanks to the new rules, they’re far more affordable.

What You Need to Do Now

You don’t need to be an expert. Just do three things:- Check your current plan’s formulary - look up every generic you take. Use the Medicare Plan Finder.

- Compare at least two other plans - even if you’re happy now, another plan might cover your drugs better.

- Call your pharmacy - ask if they’ve had issues filling your prescriptions. If they say “we had to charge you full price,” that’s a red flag.

Don’t wait until you get a bill you can’t afford. The system is designed to help you - but only if you know how it works.

Are all generic drugs covered under Medicare Part D?

No, not every generic is covered. Each Part D plan must include at least two generics per drug class, but they don’t have to cover every version. Plans choose which generics to include based on cost and effectiveness. Always check your plan’s formulary before enrolling.

Why is my generic drug not covered even though it’s the same as the one I used to take?

Your plan may have switched to a different generic version of the same drug. Even if two generics are chemically identical, they’re treated as separate products under Medicare rules. If the new version isn’t on your plan’s formulary, you’ll pay full price. You can file a coverage exception if your doctor says the original version is medically necessary.

Does the $2,000 out-of-pocket cap apply to generics only?

No. The $2,000 cap applies to all covered drugs - generics and brand-name alike. Once you hit that limit, you pay nothing for any covered medication for the rest of the year. This includes both generics and brand-name drugs.

How do I know if my plan covers my generic medication?

Use the Medicare Plan Finder tool on Medicare.gov. Enter your exact drug name (including manufacturer if possible) and your zip code. The tool will show you which plans cover it and at what tier. Always double-check this each fall during Open Enrollment - formularies change every year.

Can I switch plans if my generic drug is dropped from coverage?

Yes. If your plan removes a drug from its formulary during the year, you can switch to another plan outside of Open Enrollment. This is called a “special enrollment period.” You can also request a coverage exception from your current plan. If approved, they’ll cover the drug for the rest of the year.

Do I need to pay a deductible for generic drugs?

Only if your plan has one. The 2025 standard deductible is $615, but 52% of Part D plans offer a $0 deductible. If your plan has no deductible, you start paying your 25% coinsurance right away. Always check your plan’s deductible before choosing it.

Amber Lane

January 20, 2026 AT 13:20My mom pays $0 for her blood pressure med now. Game changer.

Stephen Rock

January 21, 2026 AT 23:15Let’s be real - the system’s still rigged. They cover two generics but make you jump through hoops to get the one your body actually tolerates. And don’t get me started on the ‘dispense as written’ loophole. It’s a paperwork nightmare disguised as consumer protection. I’ve spent more time fighting insurers than I have on my actual health.

michelle Brownsea

January 23, 2026 AT 14:16It’s not just about cost - it’s about dignity. People are being forced to switch medications because of corporate greed disguised as ‘formulary optimization.’ And yet, we’re told to be grateful for the $2,000 cap? That’s a bandage on a hemorrhage. The government should mandate coverage of all generics in a class - period. This isn’t a market, it’s a life-or-death system.

Andrew Rinaldi

January 24, 2026 AT 20:46I think the real win here is that more people are finally paying attention. For years, this stuff was buried in fine print. Now, at least, there’s a conversation. I’ve seen friends go from paying $150/month for a generic to $10 - just by switching plans during open enrollment. It’s not perfect, but awareness is the first step toward real change.

Gerard Jordan

January 26, 2026 AT 07:33Just switched my dad to a mail-order plan - saved him $200 this quarter 🎉. Also found out his ‘new’ generic was the exact same pill as before, just a different label. Pharma companies are wild. 🤯

Roisin Kelly

January 28, 2026 AT 04:24They’re lying about the $2,000 cap. I know a woman who hit it and still got billed for her insulin because the plan ‘didn’t recognize’ the generic. This is all just a PR stunt. The real savings? They’re hiding it in the fine print. You think you’re safe? You’re not.

Malvina Tomja

January 28, 2026 AT 17:48Let me cut through the noise: if you're on more than two generics, you're being exploited. Plans don't care about your health - they care about profit margins. The ‘two generics per class’ rule? It’s a loophole that lets them cherry-pick the cheapest versions - even if they cause side effects. And yes, I’ve seen people go into renal failure because their plan swapped their kidney-safe generic for a cheaper, inferior one. This isn’t healthcare. It’s a casino.

Ashok Sakra

January 30, 2026 AT 08:45Bro, I live in India and we pay $1 for generics. Why is America so broken? I feel bad for you guys. Just ask your doctor for the cheapest one - they know which one is really the same. No need to fight the system. Just switch.