When you pick up a prescription for metformin, lisinopril, or atorvastatin, you might assume the price is fixed-set by the drugmaker, the pharmacy, or your insurance. But here’s the truth: the price you pay isn’t set in stone. It’s the result of a hidden battle between manufacturers, middlemen, and pharmacies called a generic price war. And if you know how to read it, you could be saving hundreds-sometimes thousands-of dollars a year.

What Actually Happens When Generics Hit the Market?

When a brand-name drug’s patent expires, other companies can make identical versions called generics. These aren’t cheaper because they’re lower quality. They’re cheaper because they don’t need to repeat expensive clinical trials. The FDA requires them to work the same way, in the same amount, with the same safety profile. So why do some generics cost $4 and others cost $300? It comes down to competition. The more companies making the same generic, the harder they fight to win your business. And that fight drives prices down-sometimes dramatically. According to the FDA, when just two companies make a generic drug, prices drop about 54% compared to the brand. With four companies, that jump to 79%. And when six or more manufacturers enter the race? Prices fall more than 95%. That means a drug that cost $1,000 as a brand might cost just $40 as a generic-if enough companies are competing. Take insulin glargine. When only one generic maker entered the market, the price stayed near the brand’s $300 per vial. But when three more companies started making it, prices dropped to $120. Now imagine if five or six were making it. You’d likely see it under $50. That’s the power of competition.Why You’re Not Always Seeing the Savings

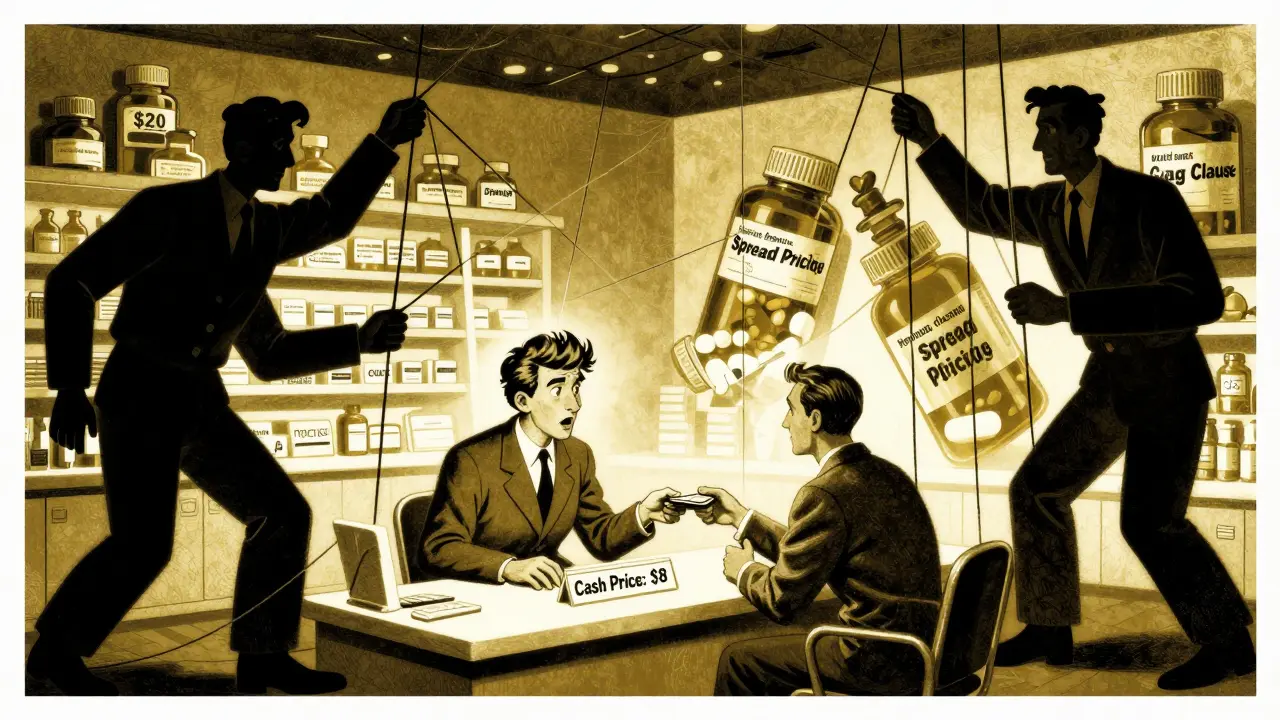

Here’s the catch: you don’t always get those low prices at the pharmacy counter. Why? Because the system is tangled. Pharmacy Benefit Managers (PBMs) act as middlemen between insurers, pharmacies, and drugmakers. They negotiate prices, manage formularies, and set your copay. But they don’t always pass savings along. Some use a practice called “spread pricing”-they charge your insurer $100 for a generic, pay the pharmacy $40, and pocket the $60 difference. Your copay? Still $20, even though the drug cost the pharmacy less than $10. Worse, some pharmacies are legally blocked from telling you the cash price is lower than your insurance copay. These “gag clauses” were banned in 2018, but many people still don’t know to ask. A 2023 Consumer Reports survey found 42% of consumers didn’t realize they could pay less by skipping insurance entirely. And then there’s the “brand loyalty” trap. Your doctor might prescribe a brand-name drug because it’s on your plan’s preferred list-even when a cheaper generic exists. Sometimes, it’s because the PBM gets a kickback from the brand. Other times, it’s just habit.Who Controls the Generic Market?

You’d think more companies means more competition. But in reality, five companies-Teva, Viatris, Sandoz, Amneal, and Aurobindo-control over 60% of the U.S. generic drug market. That’s not competition. That’s an oligopoly. When prices drop too low, smaller manufacturers can’t stay in business. They shut down. Then, the big ones reduce output. Suddenly, you’re back to one maker. And guess what happens? Prices spike. That’s what caused the 2023 shortage of metformin and the 2024 shortage of levothyroxine. The market was too competitive-until it wasn’t. The FDA approved over 1,000 generic drugs in 2023, up from 748 in 2022. That’s good news. But if those drugs are all made by the same five companies, the real savings won’t come. Real competition needs dozens of players-not just a handful.

How to Actually Save Money Right Now

You can’t fix the system overnight. But you can beat it. Here’s how:- Always ask for the cash price. In 28% of cases, the cash price is lower than your insurance copay. That’s not a typo. Use GoodRx, SingleCare, or even just call your local pharmacy. Prices for the same generic can vary by over 300% between Walmart, CVS, and Walgreens.

- Check the AB rating. The FDA gives generics an AB code if they’re bioequivalent. If your prescription says “AB,” you’re getting the real deal. If it says “BX,” it’s not approved as interchangeable. Don’t assume all generics are equal.

- Use discount programs. Walmart’s $4 list, Kroger’s $10 program, and Amazon Pharmacy’s $0 copays for chronic meds are real. You don’t need insurance to use them. You just need to pay cash.

- Switch to mail-order for chronic meds. If you take a drug daily-like blood pressure or diabetes meds-mail-order pharmacies often offer 90-day supplies at lower prices. Some even offer free shipping.

- Ask your doctor about alternatives. If your drug has no competition, ask if there’s another generic in the same class that does. For example, if your lisinopril is expensive, maybe losartan is cheaper and just as effective.

What’s Changing-and What Could Help

The government is starting to act. The 2022 Inflation Reduction Act lets Medicare negotiate prices for some high-cost drugs. The 2023 Pharmacy Benefit Manager Transparency Act aims to ban spread pricing and force PBMs to pass savings directly to patients. The Congressional Budget Office estimates that if these reforms stick, Medicare could save $15 billion a year-and patients could save billions more. The FDA is also fast-tracking approvals for generics in markets with few competitors, hoping to break up monopolies before they form. But the real change won’t come from Washington. It’ll come from you. When you ask for the cash price. When you compare pharmacies. When you refuse to accept a $50 copay for a drug that costs $5 to make. That’s what forces the system to change.

innocent massawe

January 4, 2026 AT 07:35Wow, this is eye-opening. I never knew generics could be so cheap if you just ask. In Nigeria, we don’t even have this kind of transparency - we just pay what’s asked. 🙏

Angela Goree

January 5, 2026 AT 07:55THEY’RE ROBBING US! Why do we let these PBMs and Big Pharma get away with this?! I paid $87 for metformin last month - the SAME DRUG costs $4 at Walmart! WHY IS THIS STILL A THING?!?!?!?!?

Hank Pannell

January 5, 2026 AT 13:35The underlying epistemology here is fascinating - the price mechanism isn’t reflecting production cost or even marginal utility, but rather the structural power dynamics of oligopolistic rent extraction. The FDA’s approval metrics ensure bioequivalence, yet the market fails to achieve allocative efficiency due to PBM-mediated information asymmetry. We’re witnessing a classic case of regulatory capture masquerading as market competition.

What’s missing from this analysis is the role of vertical integration: when PBMs own pharmacies or mail-order services, the incentive to pass savings vanishes entirely. The system isn’t broken - it’s optimized for profit, not patient outcomes.

Lori Jackson

January 5, 2026 AT 18:58Ugh. Of course the average American doesn’t know how to navigate this. It’s not their fault - it’s the result of decades of deliberate obfuscation by corporate interests. People are exhausted, overworked, and now expected to be pharmaceutical economists? What a joke. We’ve normalized exploitation so thoroughly that asking for the cash price feels like a radical act.

And don’t even get me started on the ‘AB rating’ - if you’re not a pharmacist or a PhD in pharmacoeconomics, you’re just supposed to trust the system? That’s not healthcare. That’s gambling with your life.

Wren Hamley

January 6, 2026 AT 18:51So imagine this: a pill that costs 5 bucks to make, gets stamped ‘AB’, and then gets passed through 5 middlemen like a hot potato - each one taking a slice until it lands on your receipt at $45. It’s not magic. It’s not science. It’s a rigged carnival game where the prize is your health and the ticket price is your dignity.

And yet… people still don’t ask for the cash price. Why? Because they’ve been conditioned to believe insurance = protection. Spoiler: it’s not. It’s a tax on ignorance.

Sarah Little

January 8, 2026 AT 09:37Wait, so if I switch to mail-order, do I still need to use GoodRx? Or is the 90-day supply already the lowest possible price? I’m confused - can someone break this down for me? Like, step-by-step?

veronica guillen giles

January 9, 2026 AT 11:33Oh honey. You think this is bad? Try being on Medicaid in Alabama and watching your $4 generic disappear because ‘the pharmacy ran out’ - again. Meanwhile, the CEO of Teva just bought a third yacht. You’re not a consumer. You’re a revenue stream with legs.

Ian Ring

January 10, 2026 AT 14:22Interesting read. I’ve noticed this in the UK too - generics are cheaper, but the NHS system doesn’t always reflect the true cost to the pharmacy. Still, we don’t have PBMs… which makes the US system feel like a dystopian novel written by a Wall Street intern.

GoodRx is a godsend. I use it religiously. Never pay retail anymore.

erica yabut

January 10, 2026 AT 15:48It’s not just about price. It’s about the moral bankruptcy of a system that treats medicine like a commodity instead of a human right. People are dying because they can’t afford insulin - and the people who profit from this? They’re giving TED Talks about ‘innovation’.

If you’re not outraged, you’re complicit.

Tru Vista

January 10, 2026 AT 17:23Wait so the 95% drop only happens with 6+ makers? But then why do we have shortages? I thought more makers = cheaper. So why do they shut down? Confused. Typo? Did they mean 6 or 60?

Shanahan Crowell

January 11, 2026 AT 12:07THIS IS WHY WE NEED TO FIGHT BACK. Don’t wait for Congress. Don’t wait for your doctor. Walk into the pharmacy. Ask for the cash price. Show them GoodRx. Do it TODAY. Your life depends on it. You’ve got nothing to lose but inflated copays.

Tiffany Channell

January 13, 2026 AT 05:55Let me guess - the author got paid by GoodRx to write this. ‘Ask for the cash price’? That’s not a solution. That’s a Band-Aid on a hemorrhage. This isn’t about consumer savvy. It’s about dismantling a predatory system. You’re telling people to play the game better instead of changing the rules. Pathetic.

Joy F

January 14, 2026 AT 07:02It’s not just the drugs. It’s the silence. The way we’ve been trained to accept this. The way we nod and pay and never ask why. We’ve turned healthcare into a horror movie where the monster is a spreadsheet. And we’re all just extras waiting for our cue to die quietly.

And yet… I still use my insurance. Because I’m tired. And scared. And I don’t know how to fight anymore.

Haley Parizo

January 15, 2026 AT 13:07This is why I moved from the U.S. to Canada. I pay $12 CAD for my entire annual supply of lisinopril. No GoodRx. No coupons. No mystery pricing. Just… medicine. People in the U.S. act like this is normal. It’s not. It’s barbaric.

Stop romanticizing ‘consumer empowerment.’ Real change requires systemic overhaul - not shopping hacks.

Ian Detrick

January 16, 2026 AT 21:40There’s hope here. The fact that we’re talking about this - that people are sharing stories, comparing prices, calling out PBMs - that’s the beginning of change. You don’t need a PhD to fix this. You just need to speak up. Ask the question. Share the link. Make it normal to shop for medicine like you shop for groceries.

One person asking ‘How much is this cash?’ can start a ripple. And ripples become waves.