When you pick up a generic version of your prescription, you’re usually paying a fraction of what you’d pay for the brand-name drug. That’s not luck. It’s the result of a deliberate, decades-long system designed to let competition do the work - not government price setters. In the U.S., generic drugs make up 90% of prescriptions filled but only 23% of total drug spending. That’s because once a patent expires, multiple companies jump in to make the same medicine, and prices crash - often by 80-90% within two years.

Why the Government Doesn’t Set Generic Drug Prices Directly

You might think the government steps in to cap prices for generics, like it does for some brand-name drugs under the Inflation Reduction Act. But it doesn’t. And for good reason. The system already works. The FDA’s Abbreviated New Drug Application (ANDA) pathway, created by the Hatch-Waxman Act in 1984, lets generic makers skip expensive clinical trials. They just prove their drug is bioequivalent to the brand. That cuts development costs from $2.6 billion to just $2-3 million. More companies enter the market. Prices drop. No price control needed.The Medicare Drug Price Negotiation Program, launched in 2022, targets 15 high-cost brand-name drugs like Ozempic and Wegovy. But generics? Excluded. Why? Because the Department of Health and Human Services found that generic markets are already competitive. The Congressional Budget Office confirmed it: applying international price benchmarks to generics would save Medicare only $2.1 billion a year - just 0.4% of total generic spending. Meanwhile, negotiating brand-name drug prices could save $158 billion. The math is clear: focus where it matters.

How Competition Drives Generic Drug Prices Down

The key to low generic prices isn’t regulation - it’s the number of makers. When three or more companies sell the same generic drug, prices stabilize at just 10-15% of the original brand’s cost. That’s not a guess. It’s from a 2021 FTC study. In the U.S., there are an average of 14.7 manufacturers per generic drug. Compare that to Europe (8.2) or Japan (5.3). More competitors = sharper price cuts.Take sertraline, the generic for Zoloft. In 2023, over 40 companies made it. The price dropped to under $5 for a 30-day supply at many pharmacies. That’s not because the government said so. It’s because if one company tries to raise prices, another undercuts them. The market self-corrects.

Even when prices spike - like that one Reddit user who saw sertraline jump from $4 to $45 - it’s rare. The FDA’s 2023 Drug Shortage Report shows only 0.3% of generics had unusual price hikes. Most of those were tied to supply chain issues, not greed. And even those spikes don’t last. When new manufacturers enter, prices fall again.

The Real Government Role: Speeding Up Approval and Stopping Anti-Competitive Moves

The government doesn’t set prices for generics. But it does clear the path for them to enter the market faster and stay competitive.The FDA’s Generic Drug User Fee Amendments (GDUFA), reauthorized in 2022 with $750 million in industry fees, pushed approval times from 18 months down to 10 months. In 2023 alone, the FDA approved 1,083 generic drugs - a 35% increase since 2017. That’s not a coincidence. Faster approvals mean more competition sooner.

But competition doesn’t always happen fairly. Brand-name companies sometimes pay generic makers to delay entry - a practice called "pay-for-delay." The FTC calls it anti-competitive. In 2023, they challenged 37 of these deals. If those generics had entered on time, consumers could’ve saved $3.5 billion that year. The FTC also blocked the proposed Teva-Sandoz merger in January 2024 because it would’ve reduced competition for 13 generic drugs. That’s the government’s real job: keeping the playing field level.

Why Some Generic Drugs Disappear - And What That Means

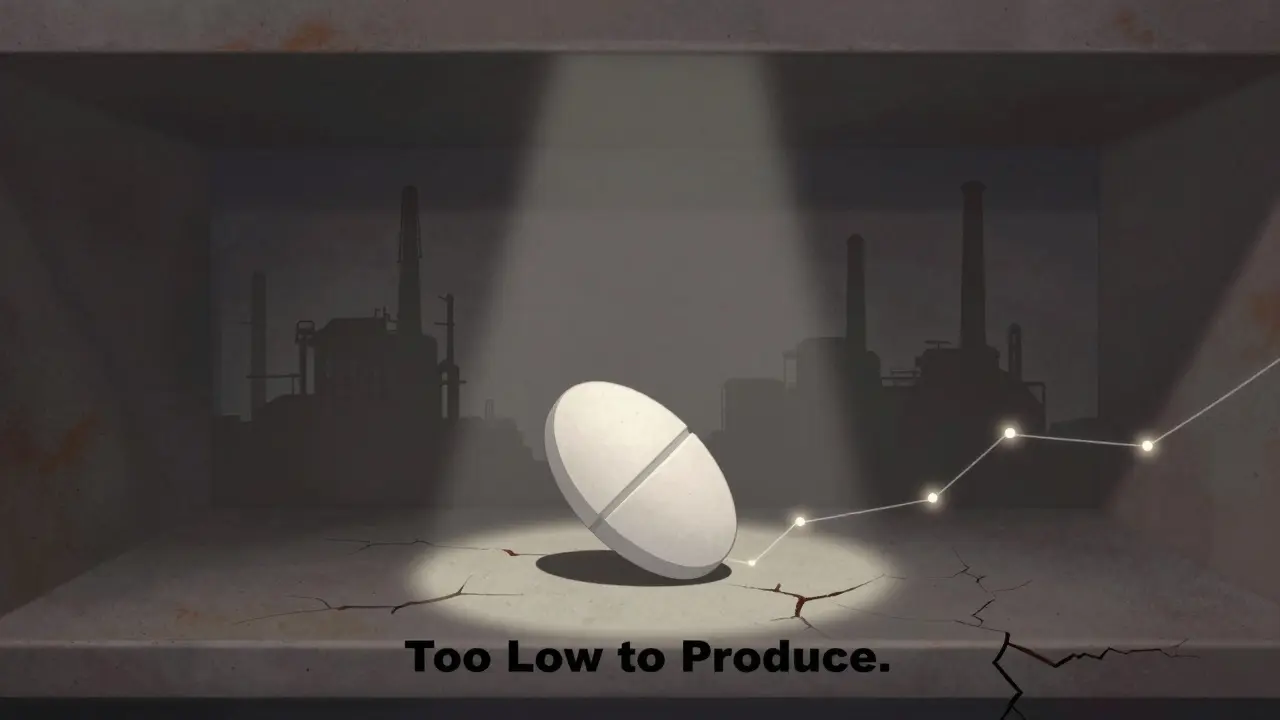

Low prices aren’t always good. Sometimes, they’re too low.Manufacturers need to make a profit. If the price of a generic drops below the cost to make it - including packaging, testing, and compliance - they stop producing it. That’s what happened with 18% of hospital pharmacists surveyed by ASHP in 2024. They reported shortages of critical generics because manufacturers quit. Forty-three percent said prices had fallen below production costs.

Take doxycycline, a cheap antibiotic used for everything from acne to Lyme disease. In 2022, it was priced at $0.02 per pill. Some manufacturers couldn’t cover shipping and regulatory costs. They stopped making it. Shortages followed. The FDA had to step in with emergency imports.

This isn’t a failure of the system - it’s a sign it’s working too well. The market pushed prices so low that even efficient producers couldn’t survive. That’s why experts like Dr. Rena Conti from Boston University say the solution isn’t price controls. It’s fixing the supply chain and making sure manufacturers can still profit at low prices.

What’s Changing in 2025 and Beyond

The government’s approach to generic pricing isn’t changing - it’s getting smarter.The FDA’s 2024-2026 plan focuses on "complex generics" - drugs with tricky formulations like inhalers or injectables. These take longer to approve. In 2023, only 38% of complex generic applications met the 10-month target. The FDA created a new submission template to fix that - and pilot results show review times dropped 35%.

Meanwhile, the FTC’s Pharmaceutical Task Force has brought 12 enforcement actions since 2023 to stop anti-competitive behavior, recovering $1.2 billion for consumers. CMS is also cracking down on insurance plans that force unnecessary prior authorization on generics. That rule change alone could save Medicare beneficiaries $420 million a year.

And the future? The CBO projects generic drug prices will keep falling at 3.5% annually through 2030. Branded drugs? Only 0.8%. That’s because competition, not regulation, is the engine.

What Patients Really Think

Ask people who use generics, and most are happy. A 2024 KFF survey found that 76% of Medicare Part D users pay $10 or less for their generic prescriptions. Only 28% pay that little for brand-name drugs. Satisfaction with generic affordability? 82%. For brand-name users? Just 41%.On Drugs.com, 87% of the 12,450 reviews from early 2024 called generics "affordable" or "cost-effective." Only 5% mentioned pricing problems. Most people don’t even think about the system behind it. They just know they can afford their meds.

But the quiet crisis isn’t price - it’s access. When a generic disappears because the price is too low, patients don’t get a choice. They get a delay. Or a switch to a different drug. Or a trip to the ER. That’s why fixing the supply chain matters more than ever.

The Bottom Line

Government doesn’t control generic drug prices. It doesn’t need to. The market does it better. By removing barriers to entry, speeding up approvals, and stopping anti-competitive tricks, the system keeps prices low without bureaucrats setting numbers. The goal isn’t to lower prices further - it’s to make sure enough manufacturers stay in the game so they never disappear.For patients, that means more choices. For taxpayers, it means lower spending. For the system, it means sustainability. The real success story isn’t a price cap. It’s competition - working exactly as it should.

Madhav Malhotra

January 10, 2026 AT 16:25Man, this is why I love how India handles generics too - we’ve been making cheap meds for the world for decades. No price caps needed, just smart manufacturing and scale. My uncle’s diabetes meds cost less than a chai here, and they work just as good. The U.S. system’s not broken, it’s just… overthought.

Jennifer Littler

January 11, 2026 AT 18:03The ANDA pathway’s the unsung hero of pharmaceutical economics - bioequivalence without Phase III trials reduces marginal cost to near-zero, enabling perfect competition in a market with low barriers to entry. The FTC’s enforcement of Hatch-Waxman anti-competitive clauses is the only regulatory intervention required. Any price-setting mechanism introduces deadweight loss.

Jason Shriner

January 11, 2026 AT 23:02so the government doesn't set prices... but like... it does? by approving 1000 generics a year? and blocking mergers? and paying for faster reviews? wow. what a coincidence. the 'market' is just the fda with a better PR team.

Alfred Schmidt

January 12, 2026 AT 18:26YOU THINK THIS IS FAIR?!?! 0.02 cents per pill?!?! That’s not capitalism - that’s exploitation! Companies are going bankrupt making life-saving drugs?! And you call that ‘working’?!?! The FDA is a puppet of Big Pharma - they’re letting people die so shareholders can get bonuses!!!

Vincent Clarizio

January 13, 2026 AT 03:14Let’s zoom out here - we’re not talking about pills, we’re talking about the philosophical tension between human dignity and market efficiency. When a drug costs less than a candy bar, are we valuing life too little? Or are we celebrating the triumph of human ingenuity over monopolistic greed? The market doesn’t care about suffering - but the FDA, by enabling competition, becomes the silent moral agent in this drama. And yet… when the price drops too low, the system collapses. So is the real problem not the market… but our inability to accept that some things - like survival - can’t be priced? We need a new economic model. One where profit isn’t the only metric. Maybe… a stakeholder capitalism for medicine?

Sam Davies

January 13, 2026 AT 20:38Oh wow, the U.S. is the only country where competition magically fixes everything. In the UK, we just negotiate prices like adults. But sure, let’s pretend 14.7 manufacturers somehow equals ‘fairness’ while people ration insulin. How quaint.

Christian Basel

January 15, 2026 AT 06:00the fda approval times are still too slow. and pay-for-delay is still a thing. so no, the system isn't working. it's just… less broken than brand names.

Alex Smith

January 16, 2026 AT 17:25So… the government doesn’t set prices… but it removes barriers, speeds up approvals, and sues companies that try to cheat? That’s not ‘no intervention.’ That’s ‘smart intervention.’ You don’t need to set a price if you make sure there are enough players to force it down. This isn’t magic - it’s policy. And it’s working. Now if only we could fix the supply chain so the cheap drugs don’t vanish…